Peerless Tips About Should COGS Include Shipping

Navigating the Tricky Waters of COGS

1. What Exactly Are We Talking About When We Say COGS?

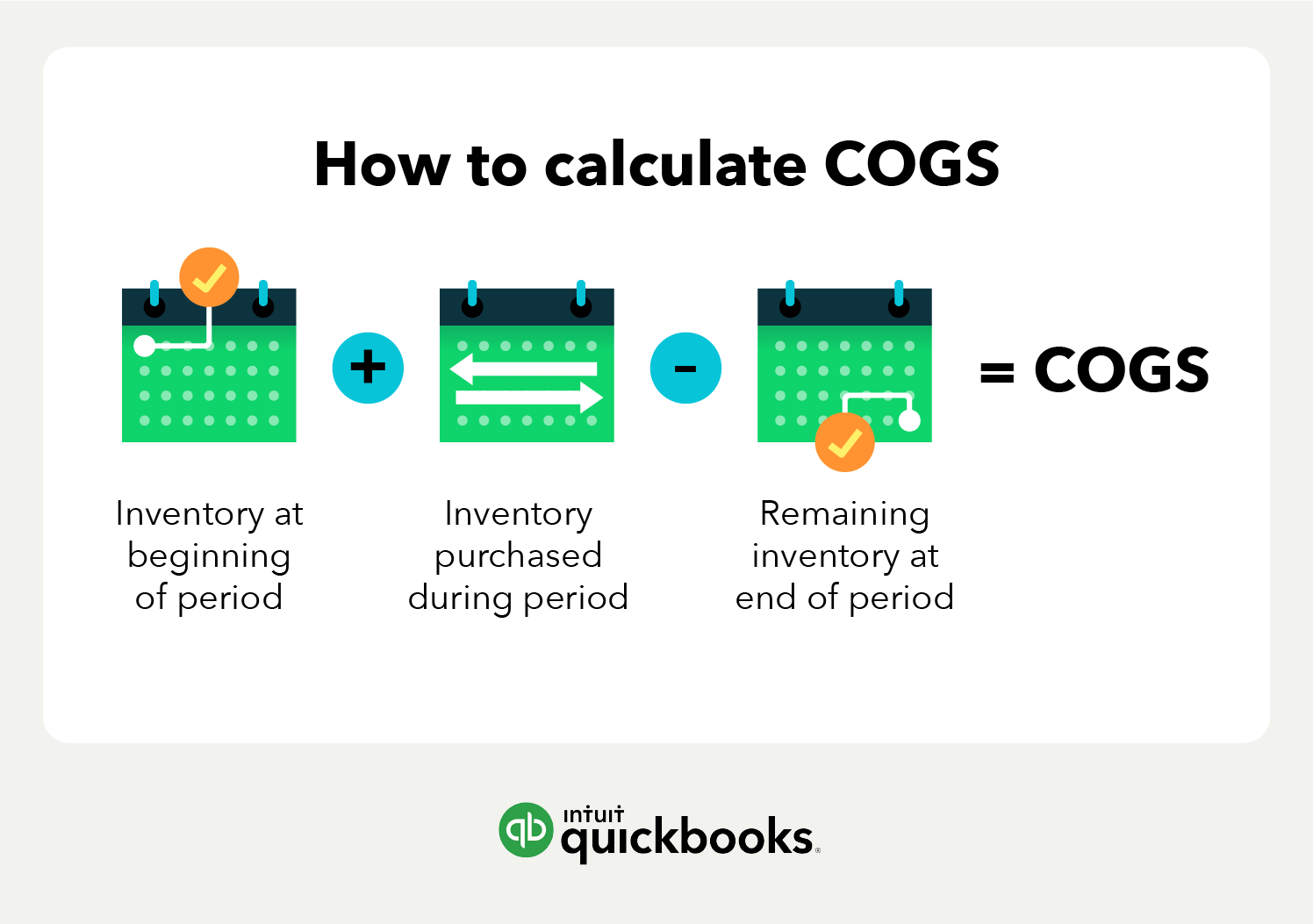

So, you're running a business, and you've probably heard the term COGS thrown around. But what does it actually mean, and why should you care? COGS, short for Cost of Goods Sold, is essentially the direct costs associated with producing the goods you sell. Think raw materials, direct labor, and even factory overhead. It's all the stuff you can directly trace back to creating that shiny widget (or delicious cupcake) you're selling. Getting a handle on your COGS is vital because it directly impacts your gross profit margin, which, in turn, affects your bottom line — how much money you actually pocket. Ignoring it is like trying to navigate a ship without a compass; you'll probably end up somewhere you didn't intend!

Why is this important, you ask? Well, imagine you're selling hand-knitted scarves. Your COGS would include the cost of the yarn, the wages (even if it's just what you pay yourself!), and maybe even the cost of electricity to run your knitting machine. It's all the "stuff" you have to spend money on before you can even think about marking up the price and making a profit. Failing to track these costs accurately can lead to underpricing your product, meaning youre basically working for free, or worse, losing money on every sale!

And remember, COGS isn't a static number. It fluctuates based on various factors, like the cost of raw materials, changes in labor rates, or even improvements in production efficiency. That's why it's crucial to regularly review and update your COGS calculations to ensure you're getting an accurate picture of your profitability. Think of it like a health check-up for your business's finances — necessary and potentially life-saving!

Therefore, understanding COGS is fundamental to pricing your products effectively, managing your profitability, and making informed business decisions. It's the foundation upon which you build your pricing strategy, and without a solid foundation, your business might be on shaky ground. So, pay attention to your COGS — your bank account will thank you!

The Million-Dollar Question

2. Unpacking the Shipping Conundrum

Here's where things get a little debatable. Whether or not shipping should be included in COGS is a question that has accountants and business owners scratching their heads. The answer isn't always straightforward, and it often depends on the specific circumstances of your business. Generally speaking, shipping costs directly related to getting your product ready for sale can be included in COGS. For example, if you have to pay to transport raw materials to your factory, that's a good candidate for inclusion.

However, shipping costs associated with delivering the finished product to the customer are generally considered selling expenses and are not included in COGS. Think about it: that cost doesn't directly contribute to making the product; it's about getting it to the buyer. This distinction is important because it affects your gross profit calculation. If you incorrectly include outbound shipping in COGS, you'll artificially lower your gross profit, which can skew your financial analysis.

But, and there's always a but, there are some exceptions. Let's say you're selling fragile items that require special packaging and handling, and those costs are significant. In that case, some argue that these costs are so closely tied to the production process (ensuring the product arrives undamaged) that they could be included in COGS. The key is consistency and transparency. Whatever approach you choose, make sure you apply it consistently across all your products and disclose your accounting policy clearly.

Ultimately, the decision of whether to include shipping in COGS rests on your specific business model, accounting practices, and the materiality of the shipping costs. It's always a good idea to consult with an accountant or financial advisor to get personalized guidance based on your unique situation. They can help you navigate the complexities of accounting and ensure you're making the best decisions for your business.

Cost Of Goods Sold Learn How To Calculate & Account For COGS

Inbound vs. Outbound

3. The Key to Unlocking COGS Accuracy

Okay, let's break this down further into two distinct types of shipping: inbound and outbound. Inbound shipping refers to the cost of transporting raw materials, components, or supplies to your business. For example, if you're a furniture maker, the cost of shipping the wood, fabric, and hardware to your workshop would be considered inbound shipping. As we touched on earlier, these costs are generally included in COGS because they are directly related to acquiring the materials necessary to produce your goods.

Outbound shipping, on the other hand, refers to the cost of transporting finished goods from your business to your customers. This includes things like postage, courier fees, and freight charges. Generally, outbound shipping costs are treated as selling expenses and are not included in COGS. They're considered costs associated with distributing your product, not with creating it. This distinction is important for accurately calculating your gross profit margin and understanding the true cost of producing your goods.

To illustrate, imagine you sell coffee beans online. The cost of shipping the raw, unroasted beans to your roasting facility is inbound shipping and is part of COGS. The cost of shipping the roasted beans to your customers is outbound shipping and is a selling expense. Keeping these categories separate allows you to analyze your costs more effectively and make informed decisions about pricing, production, and profitability.

So, remember the golden rule: if the shipping cost is related to getting the materials to you for production, it's likely COGS. If it's about getting the finished product to the customer, it's probably a selling expense. Keep them separated, and your accounting will be much clearer, and your accountant will be much happier!

The Impact on Your Bottom Line

4. The Ripple Effect of COGS on Profitability

You might be thinking, "Okay, so what if I include shipping in COGS or don't? What's the big deal?" Well, the way you classify these costs can have a significant impact on your financial statements and, ultimately, your bottom line. Incorrectly including outbound shipping in COGS will artificially inflate your COGS and, as a result, lower your gross profit. This can make your business appear less profitable than it actually is, which can affect your ability to secure funding, attract investors, or even make informed decisions about pricing and production.

Conversely, incorrectly excluding inbound shipping from COGS will understate your COGS and overstate your gross profit. While this might seem like a good thing on the surface, it can lead to inaccurate financial analysis and potentially unrealistic expectations about your business's performance. It's like using a faulty scale — you might think you're losing weight, but in reality, you're not getting an accurate picture of your progress.

Accurate COGS calculations are also essential for tax purposes. Your COGS directly impacts your taxable income, so it's crucial to ensure you're reporting these costs correctly to avoid any potential issues with the IRS. Misclassifying shipping costs can lead to errors in your tax returns, which can result in penalties or audits. Nobody wants that! Therefore, consulting with a tax professional is always a wise move to ensure you're complying with all applicable tax regulations.

In short, getting your COGS right is not just a matter of accounting accuracy; it's a matter of financial health and compliance. It affects everything from your pricing strategy to your tax obligations. So, take the time to understand the nuances of COGS and seek professional guidance when needed. Your business will thank you for it!

Keeping It Consistent

5. Consistency is Key

Regardless of whether you choose to include certain shipping costs in COGS or treat them as selling expenses, the most important thing is to be consistent in your approach. Once you've established a method for classifying these costs, stick with it. Consistency allows you to compare your financial performance over time and identify trends or anomalies. It also makes it easier to analyze your profitability and make informed business decisions.

Imagine changing your COGS calculation method every month — your financial statements would be a jumbled mess, making it impossible to track your progress or identify areas for improvement. Consistency provides a stable foundation for financial analysis, allowing you to gain valuable insights into your business's performance.

Furthermore, transparency is also crucial. Document your accounting policies clearly and disclose them in your financial statements. This helps ensure that your financial information is understandable and reliable. If you're ever audited, having clear documentation of your accounting policies will make the process much smoother and reduce the risk of any issues.

So, choose your COGS classification method wisely, document it thoroughly, and stick with it consistently. Consistency is the key to unlocking accounting sanity and ensuring the accuracy and reliability of your financial information. It's the bedrock of sound financial management and a crucial ingredient for long-term business success. And remember, if you're ever unsure about how to classify a particular cost, don't hesitate to consult with an accountant or financial advisor. They're there to help you navigate the complexities of accounting and ensure you're on the right track.

COGS Formula 101 Essential Insights For Entrepreneurs Invesp

Frequently Asked Questions (FAQs)

6. Your Burning COGS Questions, Answered!

Let's address some common questions about COGS and shipping to further clarify this topic.

7. Q

A: If shipping costs are truly insignificant, you might choose to simplify things and consistently classify them as either COGS or selling expenses, even if it's technically not the "perfect" classification. The key is to be consistent and transparent. However, it's generally good practice to track even small costs to get a more accurate picture of your overall profitability.

8. Q

A: While you have some flexibility in determining your COGS classification rules, it's important to adhere to Generally Accepted Accounting Principles (GAAP) as much as possible. Deviating too far from GAAP can make your financial statements difficult to understand and compare to other businesses. If you have a unique business model, consult with an accountant to develop COGS classification rules that are both accurate and compliant with accounting standards.

9. Q

A: Handling fees are similar to shipping costs. If the handling fees are directly related to preparing the product for sale (e.g., special packaging), they could be included in COGS. If they're related to fulfilling the order (e.g., picking and packing), they're generally considered selling expenses. Again, consistency and transparency are key!