Lessons I Learned From Tips About How To Make Bill In Excel With Formula Pdf

Creating Bills in Excel with Formulas

1. Setting Up Your Excel Invoice Template

Ever found yourself staring blankly at a spreadsheet, trying to figure out how to turn it into a professional-looking bill? You're not alone! Many small business owners and freelancers grapple with this challenge. The good news? Excel is your friend, and with a few clever formulas, you can whip up invoices faster than you can say "payment due." Let's dive in and ditch the headache!

First things first: the layout. Think about what information you absolutely need on your bill. You'll definitely want your company name and contact info at the top, followed by the customer's details. A clearly marked "Invoice Number" and "Date" are essential for record-keeping, trust me. And, of course, a well-defined table to list the goods or services you provided.

Now, the fun part: formatting! Excel's "Format as Table" feature is a lifesaver. Select the cells you want to include in your table (say, from "Description" to "Total"), and then click "Format as Table" under the "Home" tab. Choose a style you like — something professional but also reflective of your brand. This automatically adds filters, making it super easy to sort and manage your invoice data later on.

Don't forget a section for payment terms and conditions! It's vital to be clear about when payment is expected and how you prefer to be paid. Adding your bank details, accepted payment methods, and any late payment fees can save you from awkward conversations down the road. A little clarity goes a long way!

2. Using Formulas to Calculate Totals Automatically

This is where Excel really shines. Nobody wants to manually calculate totals, especially when dealing with multiple line items. Let's use formulas to automate the process and minimize errors.

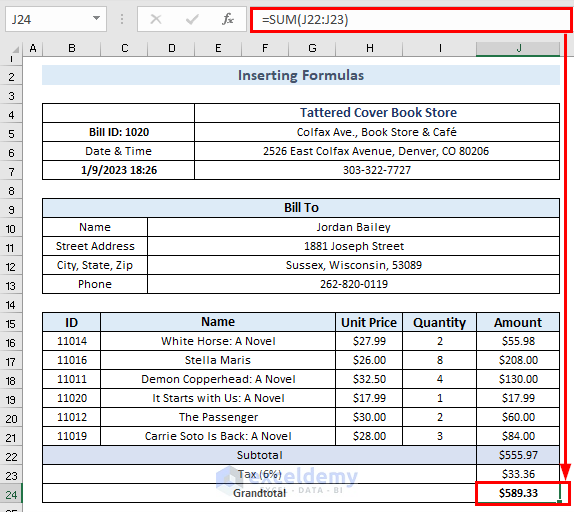

Start with a "Quantity" column and a "Unit Price" column. Then, in a "Total" column, enter the formula `=Quantity UnitPrice` (replace "Quantity" and "UnitPrice" with the actual cell references, like `=B2C2`). Excel will automatically multiply the quantity by the unit price for each row. Simply drag the fill handle (the small square at the bottom right of the cell) down to apply the formula to all your line items.

Next, let's calculate the subtotal. At the bottom of your table, create a cell labeled "Subtotal." Use the `SUM` function to add up all the values in your "Total" column. The formula will look something like `=SUM(D2:D10)` (adjust the range `D2:D10` to match your actual data range). Easy peasy!

What about taxes? Add a "Tax" line item and a cell where you can enter the tax rate (e.g., 0.05 for 5%). Then, in a cell labeled "Tax Amount," use the formula `=Subtotal TaxRate` (again, replace "Subtotal" and "TaxRate" with the correct cell references). Finally, calculate the grand total by adding the subtotal and the tax amount: `=Subtotal+TaxAmount`.

3. Adding Discounts and Other Adjustments

Sometimes you need to offer discounts or add other adjustments to your bills. No problem! Excel can handle it.

Create a "Discount" line item. You can either enter a fixed amount or a percentage. If it's a percentage, make sure to format the cell as a percentage. To calculate the discount amount, use a similar formula to the tax calculation: `=SubtotalDiscountRate` (if you're using a percentage discount) or simply enter the fixed discount amount.

Remember to adjust your grand total formula to account for the discount. It should now be `=Subtotal-DiscountAmount+TaxAmount`. This ensures that the discount is deducted from the subtotal before the tax is calculated.

You might also need to add other charges, such as shipping or handling fees. Just add new line items for these and include them in your grand total calculation. The key is to break everything down clearly so your customer understands exactly what they're paying for.

4. Saving and Exporting Your Invoice as a PDF

Once your invoice looks perfect, it's time to save it and send it to your client. But sending the Excel file directly might not be the most professional approach. Converting it to a PDF ensures that the formatting stays consistent and prevents accidental edits.

In Excel, go to "File" > "Save As." In the "Save as type" dropdown menu, choose "PDF (*.pdf)." Give your file a descriptive name (e.g., "Invoice_20240115_ClientName.pdf") and click "Save."

Before you hit "Save," click the "Options" button. Here, you can choose which parts of your worksheet to include in the PDF. You can select "Active sheet(s)" to save only the current invoice, or "Entire workbook" to save all sheets. You can also adjust the print quality and other settings.

And that's it! You now have a professional-looking PDF invoice ready to send to your client. You can attach it to an email, upload it to a cloud storage service, or even print it out and mail it (if you're feeling old-school).

5. Advanced Tips and Tricks

Want to take your Excel invoicing skills to the next level? Here are a few advanced tips:

Use Data Validation: In the "Quantity" column, set up data validation to ensure that only numbers are entered. This can prevent errors and make your spreadsheet more robust. Go to "Data" > "Data Validation" and set the "Allow" option to "Whole number."

Create Drop-Down Lists: If you frequently bill for the same products or services, create drop-down lists in the "Description" column. This saves you time and ensures consistency. Go to "Data" > "Data Validation" and set the "Allow" option to "List." Enter the list of items, separated by commas, in the "Source" field.

Conditional Formatting: Use conditional formatting to highlight overdue invoices. For example, you can set a rule to automatically highlight invoices in red if the payment due date is in the past. Go to "Home" > "Conditional Formatting" and explore the various options.

Automate Invoice Numbering: You can use formulas to automatically generate sequential invoice numbers. This eliminates the risk of duplicate numbers and keeps your records organized. Use a formula like `= "INV-" & TEXT(ROW()-1, "0000")` to create invoice numbers like "INV-0001," "INV-0002," and so on. Remember to adjust the `ROW()-1` part depending on which row your first invoice number is located.

How To Make Invoice In Ms Excel, Excel Me Bill Kaise Banaye,